Covering the Importance of Business Formation

Business formation (or company formation) at its core, incorporates a business that is both distinct from your competitors and also, gives the right value for customers and clients. Depending on your business’s sector, size, and model, the entity must strictly comply with the rules of the Indian government. And specific to Bangalore, the count of startups is an ever-hiking data. So, your venture should be formed, unique and competent.

What Legal Form You Need for Your Startup Is Depended On:

- Which legal structure is fit for your business idea?

- How to register your Startup?

- What legal documents do you need for the first step?

The Key Factors That Influence the Legal Form of a Business

“It’s hard to digest all if it is at one stretch. So, an introduction about a business or startup formation options is the next logical step. The Companies act, 2013 and Limited liability partnership act, 2008 have brought more business formation choices for entrepreneurs”

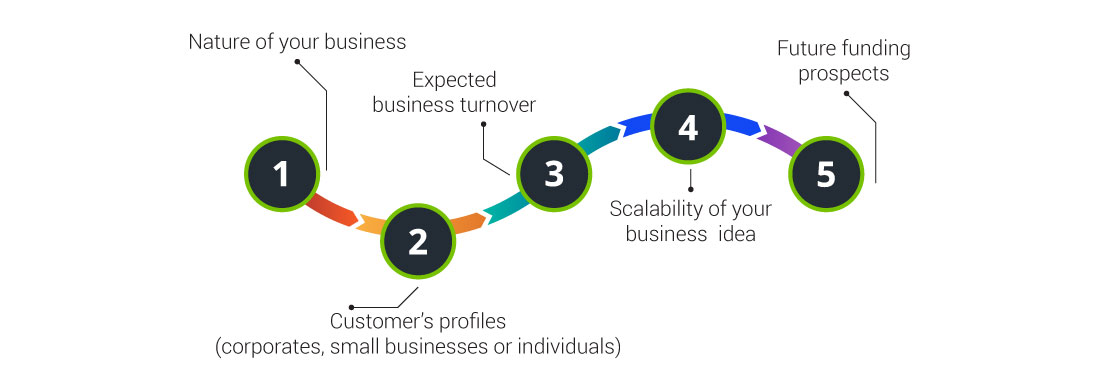

Principal Aspects that Influence the Legal Form of Your Business

From regular tax payment to service control features, every new business owner should take the important decision with their legal structure and form. Specific to the Indian startup scenario, here are the key factors that will influence your business’ legal form:

- Nature of Your Business – Whether you want to start a business in Bangalore as proprietary or partnership, depends on the purpose of entrepreneurship.

- Customer’s Profiles – Customer or consumer profile denotes your target audience, their pain points, interests, and how your business can satisfy their needs.

- Corporates – With the corporate form of business, the operations are huge here and you may have to serve customers/clients regionally and globally.

- Small Businesses or Individuals – A regular-sized business, SBAs are standardly known to have fewer employees and lesser annual revenue and are owned or operated by an individual or a private agency.

- Expected Business Turnover – The predicted business income for a given duration of the year. It is also inclusive of the total count of employees who leave a business.

- Scalability of Your Business Idea – To validate your business ideas in Bangalore, you must assess them from the financial and strategic perspective, especially its growth possibilities during high production times.

- Future Funding Prospects – The scope for receiving funds for your business in the long-run, for the sole intent to serve, develop, and achieve in the industry.

6 Main Stream Ways to Form a Business

“Every entrepreneur/promoters should take the pain to know about the pros and cons of these legal forms”

What are the 6 Main-Stream Ways to Form a Business?

Lined to delegation, coordination, administration, and supervision of the works, your business or organisational structure can be formed in 6 distinct ways:

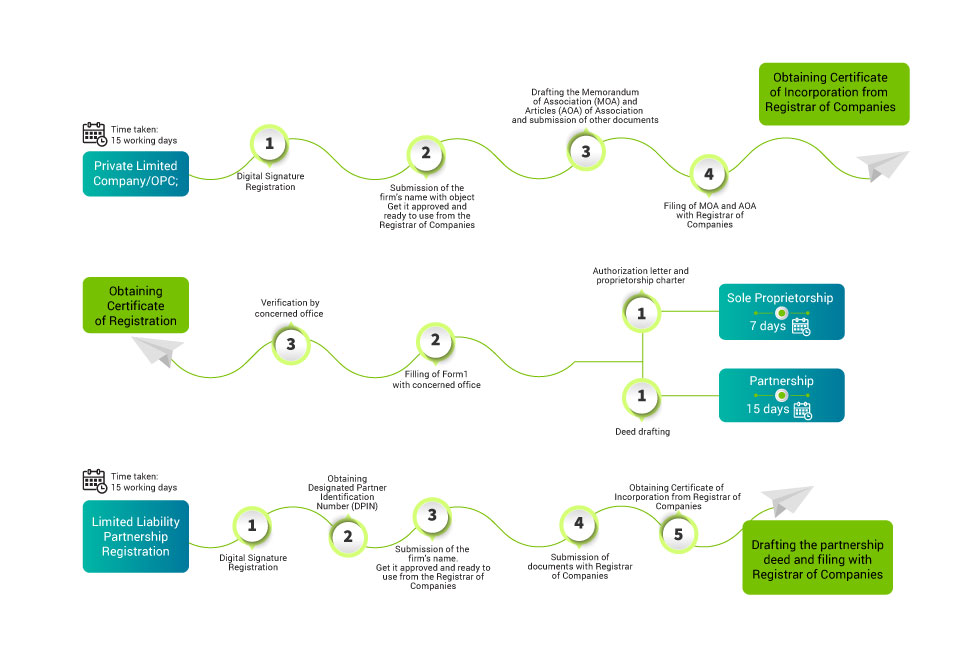

- Sole Proprietorship: You take personal responsibility in the assets and liabilities of your business. A Sole Proprietorship is a low-risk option and you can test how your actual business works using this structure.

- Partnership: Two or more entrepreneurs (partners) joining together makes up a business partnership. The profits, functions, and roles are shared by each party and the partners work coherently for the growth of their brand.

- Private Limited Company: A business entity with a small group of employees called shareholders. As per prescribed norms, for private limited company registration in Bangalore, your business should hold minimum paid-up capital.

- One Person Company(OPC): In OPC business, there is only one owner and the operations are governed by the regulations from the Indian Companies Act, 2013. With due registrar intimation, an OPC member has the right to change a nominee .

- Limited Liability Partnership: LLP-based companies can share their liabilities either with some members or by all the business partners. These brands are usually handled and overseen by the Registrar of Companies (RoC) in India.

- Public Limited Company: Both listed PLCs and unlisted PLCs can be presented in the Stock Exchange. Nearly all public limited businesses of India have a minimum of 3 directors and at least 1 secretary to form and administer the works if their investment in capital is more than 10 cores.

Procedure to a Register a Business Start-up in Bangalore

Owing to the advanced IT resources and innovative technologies of Bangalore, rest assured for a productive future. And if you have an idea to start a business in Bangalore hub, then here’s what you need to do;

- Register the Business – Primarily incorporate and certify your idea, based on the specified norms for your business structure and domain.

- Register Under Start-up India – To complete the registration, visit the official Start-up India scheme page and fill your business details; avail the tax benefits.

- Documents to Upload – Original documents such as fund letter in DIPP-approved format, a filed patent from the Journal of Indian Patent, a recommendation letter from the state or central government, etc. are to be uploaded online as PDF.

- Tax Exemption – Upon your business registration with Start-up India, you do not have to pay taxes for the 1st 3-years of incorporation. But to get that tax exemption, get your business registered with the Department for promotion of industry and internal trade (DPIIT).

- Self-Certification – Whether it is a PLC, partnership firm, or LLP, self-certify your business and prove that your registration is not less than 5 years. During operations, authenticate that your annual turnover is not more than INR 100 crore.

- Recognition Number – Once all your uploaded documents, details, and certifications are verified and approved, you will receive the unique recognition number and the certificate of incorporation or registration for your business.

We Help Setup up Your Company in Bangalore, India

It requires the right insights on the legal, financial, and operational parts to become a successful entrepreneur. To this end, if you feel that to register and start a business in Bangalore city is tedious, then we are here to help you in the same! With multi-disciplinary expertise, the CAs, managers, business administrators, and professionals at BSJ & Associates offer solid, up-to-date solutions for establishing a business setup in Bangalore. So, whether you want to update your existing resources or want to add workforce, we will get all your business needs and deeds covered online.

FAQs

How do I register for a start-up in India?

To register for a start-up in India, incorporate your business, be a part of the Start-up India scheme, submit necessary documents, and get your registration number with an official incorporation certification.

What is the timeframe to obtain a certificate of recognition as a “Start-up”?

It can take anywhere from 2 to 3 weeks to get your certificate of recognition as a “Start-up” in India. But you can get the registration number as soon as you complete the document uploading online.

How can I attract investors for my start-up?

You can attract investors for your startup-up by sketching a detailed business plan and connecting with investment Angels, fundraising platforms, crowdfunding agents, or even apply for a credible bank loan.